Contents

FP Markets offers five different accounts and trading via MT4, MT5 and IRESS. The broker offers STP and ECN trading for a relatively low minimum deposit. Deposit fees – Trading accounts can be opened in 10 different currencies and maintained via 10 different funding fp markets review methods, including cards, bank wires and e-payments such as Neteller, Skrill and PayPal. Deposited funds are available instantly on the trading account. To benefit from the ultra-low spreads there’s a cost, of course, meaning that the Raw accounts have commissions.

We partner with clients to manage their complete financial life, and provide guidance using a simplified communication process to show them their wealth opportunities. The withdrawing speed could also be attributed to this, because it’s the live agents who process the requests most of the time. And most of the time, these requests are approved within the short periods of time. Moreover, if the trading content itself is not really fulfilling, the broker itself can’t be considered any good.

The final comparison I will make is with the Australian Trade Register . Like the FCM site, the ATAs site provides a great deal of useful information, including a glossary of terms, a glossary of financial terms, and a glossary of investment products. This is one of the more “traditional” guides to looking for a top-tier forex broker. Like the FPC site, the trades and stock index and fees are listed at the bottom of each of the pages.

FP Markets mainly uses the ECN system to set up their brokerage. From the technical side, it means you’ll be connected to your end buyer or seller much faster and with little hindrance, to simplify the process. Factually, these systems offer tighter spreads per deals, but you’ll be paying more commission to your broker.

Bell to conduct independent review of CTV newsroom after Lisa LaFlamme ousted

Predict the exchange of energy products like crude oil and natural gas. Speculate on the rise and fall of company stocks and their derivatives. Choose something else if you’re not very tech-savvy or you want to trade with a Canadian-based company. Think about this online platform if you want low fees and you would prefer direct control of your portfolio. Fusion Markets works primarily with retail investors in Australia but has clients from around the world.

It also gets a black mark because it’s not regulated by Canadian authorities like the Investment Industry Regulatory Organization of Canada or the Canadian Investor Protection Fund . Access a number of advanced charting tools with technical indicators and line studies to help accurately project your trades. Make more informed decisions about when to buy and sell your investments with real-time market data. Trade currency pairs to take advantage of small fluctuations in global exchange rates. You can choose from a number of different investment options with Fusion Markets.

Some genuinely good brokers don’t have any extensive blog sections either, so the value of this point might be exaggerated. This includes products, instruments and useful content, which is very plentiful here. To concentrate on the first two bits, FP Markets tried to shove absolutely every popular tool and asset into their assortment. It includes things like currencies, shares, metals, other commodities, indices and even cryptocurrencies. One part of the reviews tells about splendid experience, but another smaller part consists of the complaints with several key points of criticism – more on that in the ‘the downsides section below.

FP Markets Canada Review

You may reallocate funding for a given target market to other approved target markets, as long as you respect the total allocation per fiscal year. CanExport SMEs may support participation in international trade events to meet with key contacts from target market. These include trade fairs, seminars, international forums or private exhibitions. CanExport SMEs supports exploratory activities as well as activities that contribute toward a longer-term strategy for internationalization. Companies may opt for a multi-year project, or submit a new application to build upon a previous project. Including up to 5 international markets helps companies accelerate their growth and pursue a regional expansion strategy.

Each sub-national market counts as one choice toward your company’s maximum of 5 target markets per project. In your application, you must disclose export sales for the chosen sub-national market. The applicant may select a maximum of 5 target markets per project. If you include more than one target market in your application, each market must be new and eligible as stated above. We will refuse activities proposed in markets we deem ineligible.

- At fpmarkets you’ll trade Forex and CFDs, among other things.

- FP Markets offers five different accounts and trading via MT4, MT5 and IRESS.

- It primarily offers a full suite of trading-related services, not just for the retail traders, except for different online trading startups and cash managers still.

- Sign up to receive the daily top stories from the National Post, a division of Postmedia Network Inc.

- While no brokers’ name is “spotless”, FP Markets is definitely as about to that as a 14-year-old operation might presumably be.

Funding recipients must keep adequate financial records and segregate CanExport project costs from their normal operation costs. The National Research Council of Canada Industrial Research Assistance Program manages your funding agreement. NRC IRAP is also responsible for processing claims and issuing payments. Please direct all questions regarding claims and reporting to NRC IRAP ([email protected]). CanExport SMEs can provide information about your application or project only to individuals named under step 2 of 13 of the application portal. You may authorize us to speak with additional individuals by sending an email to this effect ().

News

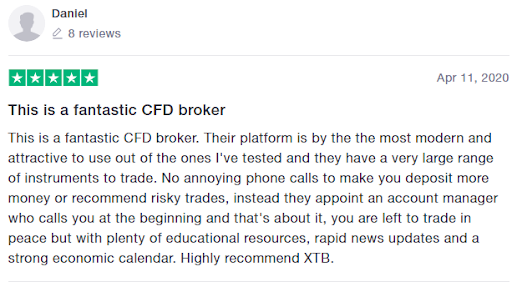

Good experience so far after almost a year of using the broker. First of all, they have quick reply and right way to solve my problem. That does help me save a lot of time to search the solution.

Minimum deposit – Opening a trading account with FP Markets is quite easy and fast, taking around 10 minutes to complete all the forms with the required information. The minimum deposit requirement for the MT4/5 Standard and Raw accounts is 100 AUD, or the equivalent on your account currency (50 USD/EUR/GBP for First Prudential Markets Ltd EU customers). Trading with FP Markets can be done via the Metatrader 4, Metatrader 5 and the IRESS platform, available on desktop terminal and mobile versions. FP Markets offers an excellent selection of more than 10,000 assets to trade, including Forex, indices, stocks, commodities and cryptocurrencies. With this platform, you can trade from the Internet browser of your choice, with no need to download extra software. Features of WebTrader include raw pricing, no requotes, a complete trading tool suite, real-time price quotes, synchronization across platforms, and more.

Proudly Supporting Local

Entries feature a descriptive title; data and market description; a list of producers/products; original sources are also provided. The main method used to store entries in MSR is by name of the report; reports can be found by keyword or by using the Advanced Search feature. In the ECN RAW account, however, the broker offers the market spreads of the interbank market and charges a commission of 3.5 dollars per 100,000 dollars traded, per half-turn.

You can sign up for a demo account to familiarize yourself with MetaTrader 4 without putting any real money on the line. You won’t have to load a minimum balance into your account to start trading. Fusion Markets offers some of the best rates available so that more of your profit goes directly into your pocket. It’s easy to open an account in a matter of minutes using Fusion Markets‘ online application.

In your application, allow 60 business days between the date you submit your application and the date your first activity takes place. In your application, verify that the total budget for your proposed activities https://broker-review.org/ is between $20,000 and $100,000. In your application, present a solid business case for undertaking the project. We recommend you also consult the program’s general list of ineligible expenses.